Philippines tries new tack: healthy man of Asia

By Rosemarie Francisco and Jason Szep,

Reuters

02/20/2012

The Philippines, the perennial "sick man of Asia", has rarely looked healthier and investors are placing their bets.

MANILA, Philippines - It is getting busy in Cristino Naguiat's spacious 5th-floor office overlooking Manila Bay.

The chairman of gambling regulator Philippine Amusement & Gaming Corp is fielding calls and booking appointments to meet possible investors in a sprawling gambling and entertainment project his government hopes will rival Las Vegas in five years.

Among them: Casino billionaire Francis Lui of Galaxy Entertainment Group Ltd and executives from Melco Crown Entertainment Ltd, controlled by Australian billionaire James Packer and the son of Macau gambling mogul Stanley Ho.

"There is growing interest. The fact that in just two weeks I have had two visitors from big companies in Macau says something about it," said Naguiat, a veteran of the gaming industry.

"Investors are having a second look at the Philippines. The fundamentals are very good."

The Philippines, the perennial "sick man of Asia", has rarely looked healthier and investors are placing their bets.

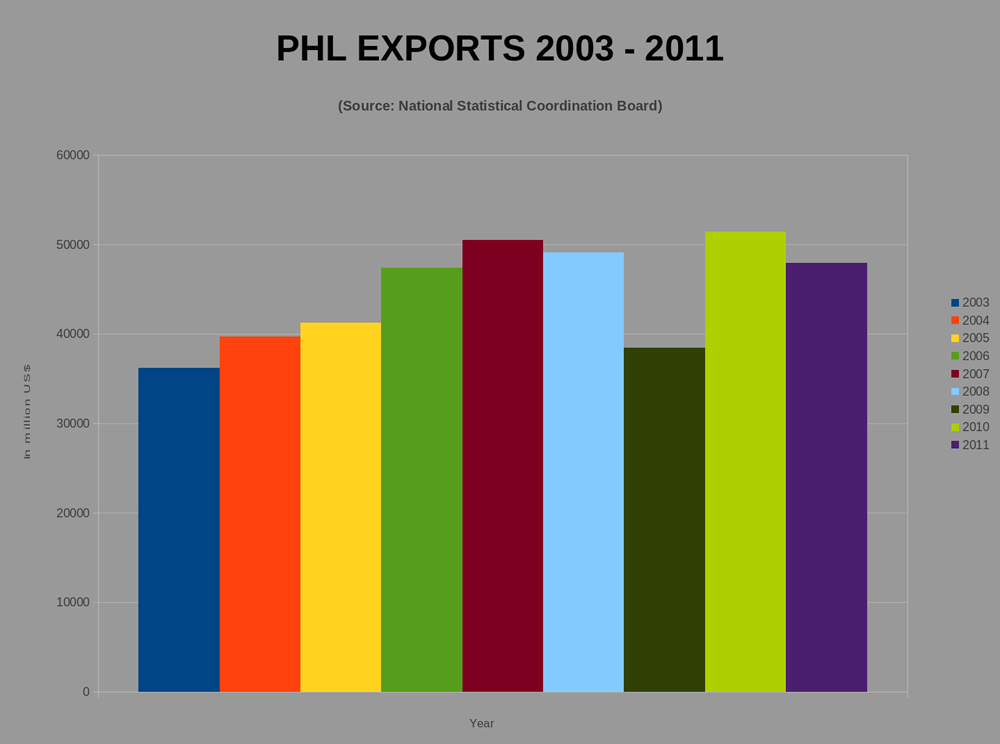

Its stock market, the best performer in Asia last year, is up nearly 13 percent this year to a record high on Monday. Benchmark 10-year government bond yields are down about 44 basis points, as prices jump.

Overseas buying of Philippine stocks hit a record $938 million in the fourth quarter, and the pace has quickened this year, according to TrimTabs Investment Research.

Economic growth is projected at about 4 percent despite global headwinds, about middle for the region.

Easing inflation, among the lowest in Southeast Asia at 3.9 percent in January, gives the central bank room to cut rates by at least another quarter-point this year. Infrastructure spending is rising.

Pressure on President

But as investors crowd into Manila's hotels, pressure is growing on Philippine President Benigno Aquinas III to go beyond usual half-hearted attempts to crack down on corruption, fix a stifling bureaucracy and find new streams of revenue in a country whose earnings usually end up in the hands of the elite.

Several crucial tests loom, including his pursuit of graft allegations against Gloria Arroyo, who until June 2010 was president, and the impeachment trial of the Supreme Court's chief justice, accused of protecting Arroyo from investigation.

Both cases could determine whether the Philippines moves ahead or withers again as a choice for investors after a brief spell of optimism.

Although he enjoys a 72 percent approval rating after 1-1/2 years in office, the odds are stacked against him.

"He is trying to transform the mindset of the people from being always suspicious to being hopeful, trustful of government," said Philippine Secretary of Finance Cesar Purisima in an interview at his home in a leafy Manila neighborhood.

"Blooming tiger"

The "rise" of the resource-rich Philippines has been hailed before, only to disappoint. About a third of the archipelego's 94 million population still lives below the poverty line, fuelling an exodus of 4,000 workers a day joining a huge Filipino diaspora seeking opportunities abroad.

In the 1950s, it boasted one of the highest per capita incomes in Asia. President Ferdinand Marcos, however, intervened with two decades of dictatorship.

Optimism surged anew when Marcos fled a "People Power" revolt in 1986 that swept to Aquino's mother, Corazon, to the presidency. On January 30, 1997, then-Finance Secretary Roberto De Ocampo uncorked champagne on the stock-exchange floor as share prices pierced all-time highs, toasting "the blooming tiger economy of Asia" and predicting the Philippines would soon catch up with South Korea and Singapore.

Another flutter of optimism occurred in mid-2007, as the economy approached its best performance since the 1990s, pushing up stock prices and luring back foreign investors. Yet again, hopes were crushed.

Corruption, cronyism and personality-driven politics flourished, squeezing the life out of reforms.

The $200 billion economy is on stronger footing this time.

Corporate balance sheets are in the best shape in a decade with gearing of less than 60 percent. The government's budget gap has narrowed to about 2 percent of the economy from a record 5.3 percent in 2002. Remittances from overseas Filipinos remain steady at 10 percent of GDP, and consumer debt as a proportion of the economy is just 7 percent, the lowest in Asia.

"The Philippines economy is clearly at the stage where it will be attracting more investor interest," said Prakriti Sofat, regional economist at Barclays Capital.

UBS offered an even rosier view. "We think the Philippines has one of the most attractive medium-term investment and consumption growth stories among emerging markets," its economists said in a Jan. 11 report, calling it a safe haven in turbulent times.

The buzz is drawing inevitable comparisons with another booming Southeast Asian former basket-case: Indonesia.

Both mostly escaped fallout from Europe's debt crisis. Both limped to the International Monetary Fund for bailouts in the Asian crisis of the late 1990s. And both have since built up their reserves and slashed debt. In the Philippines, foreign exchange reserves have more than tripled since 2005.

Indonesia has been rewarded with a return to investment grade status. Many think the Philippines is next.

Standard & Poor's Corp upgraded its outlook on Philippine debt in December to positive from stable. In June, Fitch Ratings raised the Philippines to one notch below investment grade, citing better government finances, a more stable economy and "favorable economic prospects".

"If Indonesia is investment grade, we cannot be two notches below Indonesia," Purisima said.

Like Indonesia, the Philippines' public debt as a percentage of GDP is falling, dipping to 57 percent from 79 percent in 2005. Indonesia, its population and economy more than twice the size, has done better, halving the ratio to 23.5 percent, according to Bank of America Merrill Lynch economists.

"Cautious"

But making money in the Philippines remains difficult.

Its stock prices are among Asia's most expensive. Investment protection laws are opaque and government revenue is the weakest in Southeast Asia at just 13 percent of the economy. Long-running Communist and Muslim insurgencies and complex regulations deter mining investments.

"The economy seems to be on the mend, however when you look at the stock market, it is relatively small for a country that size and the good stocks are very expensive," said emerging-market investor Mark Mobius, executive chairman of Templeton Asset Management Ltd in San Mateo, California.

Valuations have been rising: the MSCI's index of the Philippines, for instance, trades at 15.2 times 2012 earnings, up from 13.5 times a year earlier. Compare that to Singapore's 13.3 times, Malaysia at 14.3, Thailand at 10.6 and Indonesia at 12.90 times.

The problem, however, goes beyond high prices.

"You have to be quite cautious when looking at the Philippines. What's needed in the Philippines are more IPOs, more companies going to the market," said Mobius.

Just eight companies launched initial public offerings (IPOs) to list their shares in the Philippines between 2008 and 2011, a sharp contrast to 76 in Indonesia, 85 in Malaysia, 50 in Vietnam and 49 in Thailand, according to Reuters data.

That, too, appears to be changing. The Philippine Stock Exchange forecasts a doubling in total fund-raising to about $4.7 billion this year after foreign inflows into stocks rose more than three-fold in the first six weeks of the year to $351 million, overtaking net buying for all of 2009.

Multinationals needed

But Aquino needs to attract more than just portfolio money. He needs spending by multinationals.

The Philippines attracted just $1.7 billion, or 2.3 percent of the $75.6 billion of foreign direct investment (FDI) that flowed into the 10 members of the Association of South East Asian Nations in 2010, trailing Singapore, Indonesia, Malaysia, Vietnam and Thailand, the most recent ASEAN data shows.

In the 10 years to 2010, the country's annual net FDI never exceeded $2 billion.

"You have to look at the foreign investors negative list (FNL) -- no changes in 10 years; it essentially stayed the same," said Jeffrey Woodruff, executive director of the American Chamber of Commerce in Manila, referring to the list of sectors with limits to overseas investors.

"The only changes came in allowing investment in gambling, which took place a few years ago. Other than that, there's been no change in the FNL for a decade," he said.

Graft, mining troubles

A report from the World Bank's private sector arm, the International Finance Corporation, helps explain the trickle in investments: the Philippines ranked 136th out of 183 economies globally for the ease of doing business last year, and scored even lower for starting businesses. Overall, it was one place worse than the Sudan and two behind Syria.

To try to address that, the government has set up one-stop-shops in 252 economic zones to help investors.

Outside those areas, however, lie thickets of red tape and bribes for permits.

Mining investments are especially difficult.

In 2005, the Philippines' Supreme Court upheld a law allowing full foreign ownership of mining projects. Top global miners such as BHP Billiton started investing, lured by an estimated $1 trillion in untapped mineral resources. But strong opposition from the Catholic church, mine accidents, a strong anti-mining lobby and the previous unpopular government's unwillingness to counter public opinion drove most miners away.

Xstrata Plc's $5.9 billion Tampakan project in southern Philippines, Southeast Asia's largest undeveloped copper-gold prospect, has yet to move off the drawing boards, caught between local and national policies on mining.

Turning that around and improving decrepit infrastructure are central to Aquino's plans as he tries to attack graft and low tax revenue that have undermined public spending.

December's successful bidding of the Philippines' first public private partnership project, the Daang Hari SLEX expressway, will be followed by at least $1.8 billion in similar auctions this year and $17 billion in the next five years.

"The Philippines appears to be at an inflection point," said Pauline Ng, investment manager for the Pacific at JP Morgan Asset Management, which oversees $102 billion in Asian client assets. "Sectors like industrial land, property, toll roads and cement will be key beneficiaries of investment-led growth."

The country is plagued by chronically low tax collection and domestic credit too is falling -- at 8 percent as of June 2011 from around 17 percent in 2008 and well 15 percent in Indonesia and Thailand.

Aquino, 52, has vowed to enforce tax rules better before imposing new taxes or raising them. But he hasn't got far. Tax revenue rose to 12.3 percent of GDP last year, barely up from 12 percent in 2010 when it was the lowest in at least a decade.

He has now begun to raise duties on alcohol and tobacco -- steps that could generate $1.4 billion in 2012 and $2.75 billion by 2014 if passed by Congress.

He hopes these and other measures will lift the economy's growth rate to as fast as 8 percent during his single term mandate that runs to 2016.

He enjoys almost unprecedented support. He is the first president since his mother to have backing of both chambers of Congress after winning elections in May 2010 by a record margin.

He owes part of his popularity to his revered family name and its reputation for probity. His father, Benigno, was an opposition leader assassinated during the Marcos era.

"This is a rare occasion in the Philippines where you have a president who has the largest mandate ever and he wants to use that mandate to really transform the country," Purisima, the Secretary of Finance, said.

But it is unclear whether he will succeed in his biggest challenge of all: a confrontation with what he calls an obstructionist judiciary beholden to his predecessor.

As his government attempts to impeach Supreme Court Chief Justice Renato Corona, the stakes could hardly be higher. If the impeachment fails, Aquino has said it would virtually destroy his efforts to end corruption.

The final decision rests with the Senate where Aquino's party faces a struggle to win enough support to convict Corona.

Young population

Fund managers such as Ng see opportunities for gains in stocks exposed to consumers. UBS, for instance, likes PLDT , the country's largest telecommunications company, and BDO Unibank Inc.

Part of the Philippines' allure is its youthful population. Half the population is under 20 years old, many speak English -- a legacy of its past as an American colony - and the population itself is projected to swell to 190 million by 2040.

Remittances from more than 10 million overseas workers are a growing source of growth, pumping $20 billion into the economy last year.

The Philippines' business-outsourcing industry, including call centres, is also growing fast. It is projected to generate revenue of at least $13 billion this year, rising 20 percent from 2011 and more than four-fold from six years ago.

Aquino also has another wager that plays directly into hopes to transform Manila into a Southeast Asian Las Vegas.

He has targeted a rise in tourism to about 10 million visitors by the end of his term, from about 3.9 million now.

The Philippines awarded four licenses in 2008 and 2009 to operate casinos in a gambling and entertainment complex in Manila. Each Philippine licensee agreed to invest $1 billion over five years. Three of the four licenses went to a venture between Genting Malaysia Bhd and Alliance Global Group Inc , Philippine property developer Belle Corp, and ports tycoon Enrique Razon's Bloombury Investments Holding Inc.

But why should a wealthy gambler from China come to the Philippines instead of gambling resorts that have sprouted in Singapore, Macau in China and Genting in Malaysia?

"No gambler will play and lose everything in the same casino," Naguiat, the gaming regulator, said. "Look around. We're part of this circle. They'll go to Macau, they'll go Genting. They'll go to Singapore and they'll go to the Philippines."

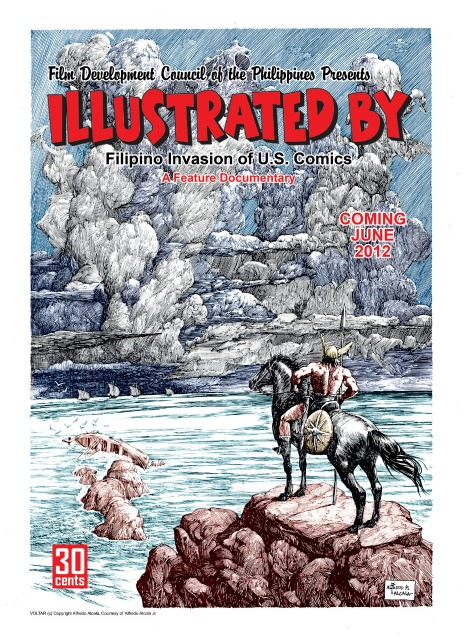

"Superman, Batman, the X-Men, Spider-Man—almost everyone is at least familiar with them, but not many know that Filipinos have drawn the exploits of these and other characters going on several decades now. I think exploring this topic would be a source of great pride for all Filipinos," says Marcelo.

"Superman, Batman, the X-Men, Spider-Man—almost everyone is at least familiar with them, but not many know that Filipinos have drawn the exploits of these and other characters going on several decades now. I think exploring this topic would be a source of great pride for all Filipinos," says Marcelo.