Philippines to outpace peers

BusinessWorld Online

DEBT WATCHER Standard & Poor’s has raised its growth forecasts for the Philippines, citing the country’s insulation from tepid external demand.

The Philippines is expected to grow by 6.5% this year and 6.3% in 2014, outpacing the rest of Southeast Asia, the credit rater said in a report on Wednesday. For the entire region, the country was bested only by China, which is estimated to grow by 7.9% and 8% this year and next, respectively.

Last month, the baseline forecast of S&P for the Philippines was 5.9% in 2013 and 5.7% next year.

The country grew by a healthy 6.6% last year, beating market expectations and the government target of 5-6%. It aims to take on a higher growth trajectory in the coming years, eyeing 6-7% in 2013 and 6.5-7.5% in 2014.

“The good news for emerging Asia is that its economic fundamentals remain strong,” S&P said.

All sectors of the economy are doing well, it cited, such as households, corporates, financial institutions and governments. The region has learned from the 1997 Asian financial crisis, avoiding the excesses that has plagued the advanced economies.

However, this doesn’t mean that it is smooth-sailing from here.

“The not-so-good news is that emerging Asia is not a world unto itself. While the region has begun to drive a larger part of its own economic momentum in recent years, growth remains reliant, to varying degrees, on demand from the advanced economies,” S&P said.

The continued weakness of the United States and Europe means that demand for exports will be lukewarm while capital will be flighty and volatile, it explained.

This could drag down Asia, particularly the newly industrialized economies of Hong Kong, Korea, Singapore and Taiwan, since their economies are very open, making for a “decent but sub-par” performance in 2013. The credit rater likened it to flying an airplane without all the engines working.

Exceptions to the rule are China and the ASEAN-5 (Association of Southeast Asian Nations), composed of Indonesia, Malaysia, Philippines, Thailand and Vietnam.

“[They] are more domestically driven, and therefore continue to enjoy relatively high and stable growth rates. This is not the case elsewhere,” S&P said. -- Diane Claire J. Jiao

Last month, the baseline forecast of S&P for the Philippines was 5.9% in 2013 and 5.7% next year.

The country grew by a healthy 6.6% last year, beating market expectations and the government target of 5-6%. It aims to take on a higher growth trajectory in the coming years, eyeing 6-7% in 2013 and 6.5-7.5% in 2014.

“The good news for emerging Asia is that its economic fundamentals remain strong,” S&P said.

All sectors of the economy are doing well, it cited, such as households, corporates, financial institutions and governments. The region has learned from the 1997 Asian financial crisis, avoiding the excesses that has plagued the advanced economies.

However, this doesn’t mean that it is smooth-sailing from here.

“The not-so-good news is that emerging Asia is not a world unto itself. While the region has begun to drive a larger part of its own economic momentum in recent years, growth remains reliant, to varying degrees, on demand from the advanced economies,” S&P said.

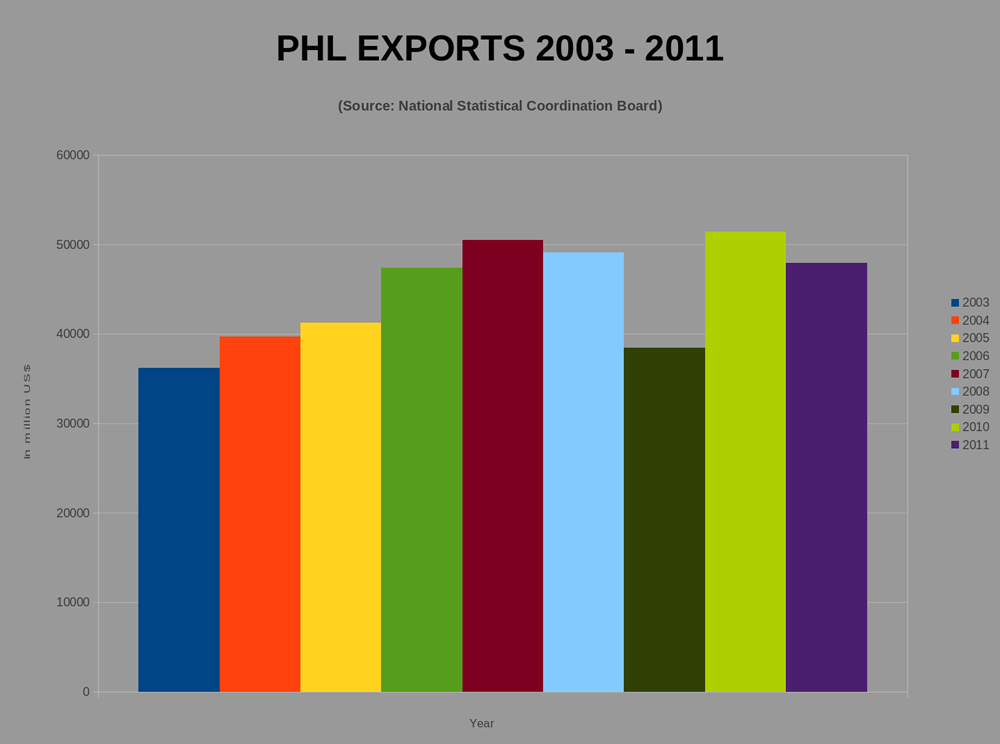

The continued weakness of the United States and Europe means that demand for exports will be lukewarm while capital will be flighty and volatile, it explained.

This could drag down Asia, particularly the newly industrialized economies of Hong Kong, Korea, Singapore and Taiwan, since their economies are very open, making for a “decent but sub-par” performance in 2013. The credit rater likened it to flying an airplane without all the engines working.

Exceptions to the rule are China and the ASEAN-5 (Association of Southeast Asian Nations), composed of Indonesia, Malaysia, Philippines, Thailand and Vietnam.

“[They] are more domestically driven, and therefore continue to enjoy relatively high and stable growth rates. This is not the case elsewhere,” S&P said. -- Diane Claire J. Jiao