Philippine stocks surge 38% in 2010

12/31/2010

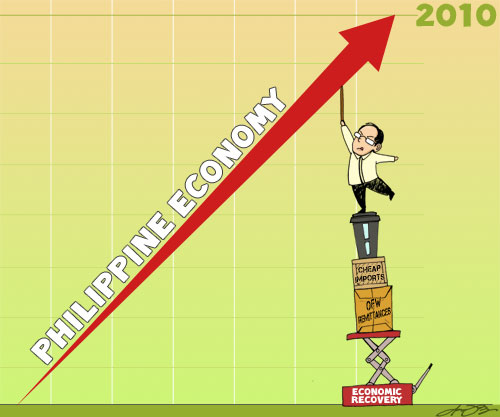

MANILA, Philippines - The local stock market posted a banner year in 2010, with the key index surging 37.6%.

As of December 30, the last trading day of the year, the Philippine Stock Exchange index (PSEi), the barometer of overall stock market performance, was up by 1,148.46 points to end at 4,201.14.

PSE Chairman Hans Sicat said strong macroeconomic fundamentals on the domestic front, as well as economic recovery overseas, boosted investor sentiment this year.

"From a sluggish 2009, gross domestic product grew by 7.5% during the first 3 quarters of 2010, on account of the robust performances of the industry and services sectors. Inflation and interest rates continue to be benign. These factors have largely buoyed stock market sentiment and reinforced investor and business confidence," he said.

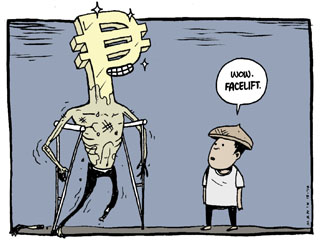

"Many of the developed, Western economies were showing signs of economic recovery despite the threat of some European nations' bankruptcies. Overall, the major global stock markets were on an uptick this year, improving capital market conditions," he added.

Total value turnover for 2010 reached P1.21 trillion, 29.8% higher than the P930.4 billion registered in 2009. The combined market capitalization of listed issues in the PSE rose by 47.1% to P8.87 trillion compared with P6.03 trillion in 2009.

Preliminary figures also show that foreign investors went into net buying territory in 2010 at P35.6 billion, higher than last year's P14.9 billion.

Total capital raised this year was P84.9 billion, largely from the initial public offerings of Cebu Air Inc., Nickel Asia and IP Converge Data Center Inc., and the stock rights offerings of First Gen Corp., SM Development Corp. and Bank of the Philippine Islands. This was an improvement over the P38.8 billion raised in 2009.

In terms of sectoral indices, the holding firms index emerged as the best performer in 2010 as it climbed by 110.28% from 2009. This was followed by the Industrial index, with 56% growth.

"As we enter a new chapter in 2011, we remain bullish that the initiatives and reforms we have started will enhance the growth of the capital markets," Sicat said.

Last July 26, 2010, the PSE rolled out a new trading system that is designed to trade a wide range of cash, debt and derivative instruments as well as improve the capacity of the PSE to handle any future sharp increases in its value turnover. The new trading system was developed by the New York Stock Exchange Technologies.

The PSE also completed the transfer of its principal office to Makati City, the financial district of the country, through an office integration project that aimed to increase the efficiency of resources and reduce costs in order to enhance shareholder value.

The PSE board has also approved the spin-off of the exchange's market regulation division into an independent and self-regulatory company to monitor activities of trading participants.

As of December 30, the last trading day of the year, the Philippine Stock Exchange index (PSEi), the barometer of overall stock market performance, was up by 1,148.46 points to end at 4,201.14.

PSE Chairman Hans Sicat said strong macroeconomic fundamentals on the domestic front, as well as economic recovery overseas, boosted investor sentiment this year.

"From a sluggish 2009, gross domestic product grew by 7.5% during the first 3 quarters of 2010, on account of the robust performances of the industry and services sectors. Inflation and interest rates continue to be benign. These factors have largely buoyed stock market sentiment and reinforced investor and business confidence," he said.

"Many of the developed, Western economies were showing signs of economic recovery despite the threat of some European nations' bankruptcies. Overall, the major global stock markets were on an uptick this year, improving capital market conditions," he added.

Total value turnover for 2010 reached P1.21 trillion, 29.8% higher than the P930.4 billion registered in 2009. The combined market capitalization of listed issues in the PSE rose by 47.1% to P8.87 trillion compared with P6.03 trillion in 2009.

Preliminary figures also show that foreign investors went into net buying territory in 2010 at P35.6 billion, higher than last year's P14.9 billion.

Total capital raised this year was P84.9 billion, largely from the initial public offerings of Cebu Air Inc., Nickel Asia and IP Converge Data Center Inc., and the stock rights offerings of First Gen Corp., SM Development Corp. and Bank of the Philippine Islands. This was an improvement over the P38.8 billion raised in 2009.

In terms of sectoral indices, the holding firms index emerged as the best performer in 2010 as it climbed by 110.28% from 2009. This was followed by the Industrial index, with 56% growth.

"As we enter a new chapter in 2011, we remain bullish that the initiatives and reforms we have started will enhance the growth of the capital markets," Sicat said.

Last July 26, 2010, the PSE rolled out a new trading system that is designed to trade a wide range of cash, debt and derivative instruments as well as improve the capacity of the PSE to handle any future sharp increases in its value turnover. The new trading system was developed by the New York Stock Exchange Technologies.

The PSE also completed the transfer of its principal office to Makati City, the financial district of the country, through an office integration project that aimed to increase the efficiency of resources and reduce costs in order to enhance shareholder value.

The PSE board has also approved the spin-off of the exchange's market regulation division into an independent and self-regulatory company to monitor activities of trading participants.

MANILA, Philippines – Manny Pacquiao’s exploits in the world of boxing was picked by Sports Illustrated as their top boxing story for 2010.

MANILA, Philippines – Manny Pacquiao’s exploits in the world of boxing was picked by Sports Illustrated as their top boxing story for 2010. Also selected by Sports Illustrated as Top 10 boxing story of the year is the

Also selected by Sports Illustrated as Top 10 boxing story of the year is the

MANHATTAN, New York - A Filipino singer is belting out popular pop music tunes in operatic style and drawing in fans of both genres.

MANHATTAN, New York - A Filipino singer is belting out popular pop music tunes in operatic style and drawing in fans of both genres. SAN FRANCISCO – Twenty-two-year old Mikhaelle Padilla Viernes is on top of the world — or at least at the top of her class.

SAN FRANCISCO – Twenty-two-year old Mikhaelle Padilla Viernes is on top of the world — or at least at the top of her class.