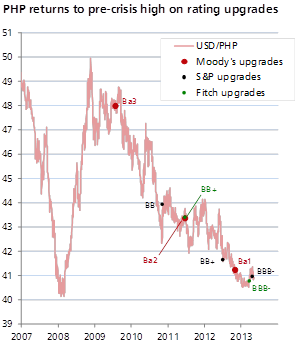

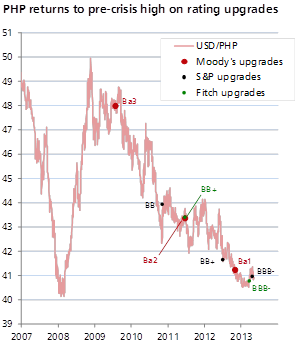

Asian economists see PHL peso more stable than peer currencies

Despite the inflow of more portfolio investments as a result of

the investment grade rating the Philippines received from Fitch Ratings and

Standard & Poor's, the peso is expected to grow stronger at a more stable

pace than other Southeast Asian currencies.

Analysts said the volatility, or unhealthy ups and downs, in the daily exchange rate will be kept on an even keel by central bank intervention coupled with the Philippines' healthy foreign reserves.

The Philippine unit is currently trading at the high 40 and low 41 per dollar, stronger than the 42 level it hovered at in the same period last year. It closed at 41.12:$1 last Friday.

DBS Bank Ltd. forecasts the peso gradually strengthening to 39.3:$1 by year-end, unchanged from its projection prior the March 27 and May 2 credit rating upgrades.

“Our optimism for the Philippine is based on the country’s strong international liquidity position,” DBS's senior currency economist in Singapore Philip Sung Seng Wee noted in an e-mail message to GMA News Online.

Philippines' foreign currency reserves stood at $84 billion as of March this year, more than double the $37.6 billion as of end-2008.

HSBC associate director for Foreign Exchange Strategy in Hong Kong Dominic Bunning sees the peso ending the year at 40.2:$1, compared with the British banking giant's 39.5:$1 projection late last year.

“While we do think that the upgrades will increase portfolio inflows for the peso, we do not necessarily think this will be excessively volatile for the currency,” Bunning said in a separate e-mail message.

As of April 26, foreign portfolio investments also known as hot money—given the ease with which they enter and exit economies—hit $1.954 billion, up 150 percent from $782.91 million a year earlier.

Hot money has been flooding Southeast Asian economies amid stuttering growth in the United States and the continuing financial crisis in Europe.

Local economists are worried that excessive flows could stoke the peso and threaten dollar-dependent sectors like exporters, business process outsourcing, and families that rely on remittances from overseas Filipinos.

Least volatile in Southeast Asia

Wee said the peso “is probably the

one of least volatile managed floating exchange rates in Southeast Asia.”

Wee said the peso “is probably the

one of least volatile managed floating exchange rates in Southeast Asia.”

He noted the peso's strength, unlike its Southeast Asian peers, “was not achieved with current account deficits, lower foreign reserves and higher external debt.”

Bunning sees the situation parallel to that analysis, saying “the Philippines retains a positive story which should ensure many flows are durable in nature.”

Currency analysts and traders, moreover, noted the central bank has been on guard against excessive portfolio flows and took steps to smooth out foreign exchange volatility in the past.

Citing the Bangko Sentral bias against a volatile peso, local currency traders who requested anonymity said the central bank buys dollars when the foreign exchange hits the lower 40 to-a-dollar to keep volatility in check.

“The CB (central bank) is not against currency strengthening. It's against excessive highs and lows and wants currency trades in a tight band daily,” a trader at a local bank said.

The central bank incurred a strained balance sheet after shielding the currency and the economy from the impact of large inflows of foreign portfolio investments, but currency analysts noted a benign inflation and good growth prospects provide room to tap policy tools.

“The central bank [has] more flexibility to cut [policy] rates, if it wants to, especially now that inflation eased to a 13-month low” of 2.6 percent, Wee said.

For his part, Singapore-based economist at Standard Chartered Jeff Ng said, “Near-term-wise, we think that the potential for further macro-prudential measures is likely to slow the pace of peso appreciation for now.”

The Bangko Sentral has dampened the appeal of interest yield by keeping it at record lows. Benchmark policy rates remained at 3.5 percent for overnight borrowing and 5.5 percent for overnight lending since last October.

It also slashed the yield on Special Deposit Accounts (SDA)—a tool to mop-up excess liquidity— thrice so far in the year to 2 percent from a premium over policy rates in January.

“Having already been cutting its SDA rate the BSP is actively managing its sterilization costs. This could continue in the future,” said Bunning, referring to savings made by the central bank on lesser SDA yields. — Graph used with permission from DBS Bank/VS, GMA News

Analysts said the volatility, or unhealthy ups and downs, in the daily exchange rate will be kept on an even keel by central bank intervention coupled with the Philippines' healthy foreign reserves.

The Philippine unit is currently trading at the high 40 and low 41 per dollar, stronger than the 42 level it hovered at in the same period last year. It closed at 41.12:$1 last Friday.

DBS Bank Ltd. forecasts the peso gradually strengthening to 39.3:$1 by year-end, unchanged from its projection prior the March 27 and May 2 credit rating upgrades.

“Our optimism for the Philippine is based on the country’s strong international liquidity position,” DBS's senior currency economist in Singapore Philip Sung Seng Wee noted in an e-mail message to GMA News Online.

Philippines' foreign currency reserves stood at $84 billion as of March this year, more than double the $37.6 billion as of end-2008.

HSBC associate director for Foreign Exchange Strategy in Hong Kong Dominic Bunning sees the peso ending the year at 40.2:$1, compared with the British banking giant's 39.5:$1 projection late last year.

“While we do think that the upgrades will increase portfolio inflows for the peso, we do not necessarily think this will be excessively volatile for the currency,” Bunning said in a separate e-mail message.

As of April 26, foreign portfolio investments also known as hot money—given the ease with which they enter and exit economies—hit $1.954 billion, up 150 percent from $782.91 million a year earlier.

Hot money has been flooding Southeast Asian economies amid stuttering growth in the United States and the continuing financial crisis in Europe.

Local economists are worried that excessive flows could stoke the peso and threaten dollar-dependent sectors like exporters, business process outsourcing, and families that rely on remittances from overseas Filipinos.

Least volatile in Southeast Asia

Wee said the peso “is probably the

one of least volatile managed floating exchange rates in Southeast Asia.”

Wee said the peso “is probably the

one of least volatile managed floating exchange rates in Southeast Asia.”He noted the peso's strength, unlike its Southeast Asian peers, “was not achieved with current account deficits, lower foreign reserves and higher external debt.”

Bunning sees the situation parallel to that analysis, saying “the Philippines retains a positive story which should ensure many flows are durable in nature.”

Currency analysts and traders, moreover, noted the central bank has been on guard against excessive portfolio flows and took steps to smooth out foreign exchange volatility in the past.

Citing the Bangko Sentral bias against a volatile peso, local currency traders who requested anonymity said the central bank buys dollars when the foreign exchange hits the lower 40 to-a-dollar to keep volatility in check.

“The CB (central bank) is not against currency strengthening. It's against excessive highs and lows and wants currency trades in a tight band daily,” a trader at a local bank said.

The central bank incurred a strained balance sheet after shielding the currency and the economy from the impact of large inflows of foreign portfolio investments, but currency analysts noted a benign inflation and good growth prospects provide room to tap policy tools.

“The central bank [has] more flexibility to cut [policy] rates, if it wants to, especially now that inflation eased to a 13-month low” of 2.6 percent, Wee said.

For his part, Singapore-based economist at Standard Chartered Jeff Ng said, “Near-term-wise, we think that the potential for further macro-prudential measures is likely to slow the pace of peso appreciation for now.”

The Bangko Sentral has dampened the appeal of interest yield by keeping it at record lows. Benchmark policy rates remained at 3.5 percent for overnight borrowing and 5.5 percent for overnight lending since last October.

It also slashed the yield on Special Deposit Accounts (SDA)—a tool to mop-up excess liquidity— thrice so far in the year to 2 percent from a premium over policy rates in January.

“Having already been cutting its SDA rate the BSP is actively managing its sterilization costs. This could continue in the future,” said Bunning, referring to savings made by the central bank on lesser SDA yields. — Graph used with permission from DBS Bank/VS, GMA News

No comments:

Post a Comment